Lasting Power of Attorney

If you would like our assistance making a Lasting Power of Attorney (LPA), we would be happy to help you. Please contact our Wills, Trusts and Probate team on 01707 329 333 or email wills@crane-staples.co.uk.

You may also find the information below to be a helpful starting point.

Table of Contents

- How much does it cost to set up a Lasting Power of Attorney?

- What is a Lasting Power of Attorney?

- What are the 4 steps of establishing capacity?

- What decisions can a Property & Financial LPA make?

- What decisions can a Health and Welfare LPA make?

- Who is the best person to be power of attorney?

- Can I have an Enduring Power of Attorney and a Lasting Power of Attorney?

- How long does Lasting Power of Attorney last?

- Should everyone have a Lasting Power of Attorney?

- Why use a solicitor for Lasting Power of Attorney?

- Contact Us

How much does it cost to set up a Lasting Power of Attorney?

Our fees for assistance with an LPA are as follows:

- One LPA (either P&F or H&W) – from £550 plus VAT at 20%, depending on complexity.

- Two LPAs (either one LPA each for a couple, or both LPAs for an individual) – from £650 plus VAT at 20%, depending on complexity.

- Four LPAs (both LPAs for a couple) – from £800 plus VAT at 20%, depending on complexity.

There is also a court registration fee of £82 per document (no VAT).

What is a Lasting Power of Attorney?

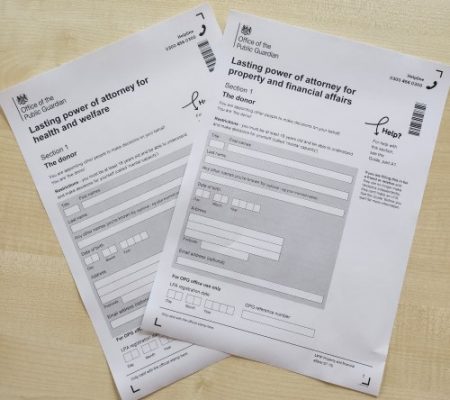

A Lasting Power of Attorney (LPA) is a legal document which allows you to appoint people you trust known as your ‘Attorneys’ to deal with matters on your behalf.

What are the 2 types of LPA?

There are two types of Lasting Power of Attorney:

Property and Financial Affairs (PFA)

A Property and Financial Affairs LPA allows your attorneys to manage any financial decisions including selling your house.

Health and Welfare (HW)

A Health and Welfare LPA gives your attorneys authority to make decisions about any matters related to your health and welfare when you lose the capacity to do so.

You can opt to make both powers or just one power but it is recommended that clients have both in place.

What are the 4 steps of establishing capacity?

To make a Lasting Power of Attorney you must have the mental capacity to do so.

- You must be able to understand the information relevant to the decision;

- You must be able to retain that information;

- You must be able to use or weigh up that information; and

- You must be able to communicate that decision.

If you are unable to do the above a new LPA cannot be made.

The Property and Financial LPA can be used as soon as it is registered with the Office of the Public Guardian, but the Health and Welfare LPA cannot be used until you have lost the capacity to make your own decisions.

More information about capacity can be found on the government website here.

Certificate Provider

An LPA must be signed by a certificate provider. A certificate provider is an independent person who can confirm that the donor has capacity to make an LPA.

This must either be:

- Someone who has known the donor personally for at least two years but is not a relative or listed in the LPA document. An example could be a friend or colleague.

A professional with the relevant skills to determine capacity. For example, a GP or healthcare professional. A solicitor can also act as a certificate provider and we offer this option at Crane & Staples.

What decisions can a Property & Financial LPA make?

A Property and Financial Affairs LPA gives attorneys authority to make decisions in respect of the donor’s (someone who makes an LPA) property and finances. For example,

- Selling or buying property

- Opening and closing bank accounts

- Ensuring that bills are paid for.

Can you sell a house with a Power of Attorney?

Your Attorneys can sell your house. For example, this may be required for the purpose of funding care home fees. (However, it must be noted that any sale proceeds will still be paid into your personal account, not the attorneys’).

Can I withdraw money if I have a Power of Attorney?

Under a Property & Financial Power of Attorney, your attorneys can withdraw money from a cash machine, pay cheques into the bank and generally manage your finances. However, they must not abuse their position as an attorney and must always act in your best interests. Therefore, it is important that you choose trusted individuals to act as your attorneys so that you have peace of mind.

What decisions can a Health and Welfare LPA make?

Health and Welfare LPA attorneys will make decisions in respect of the donor’s health and care once they have lost capacity to do so. For example,

- Choice of medical treatment

- Choice of care home

- Speaking to doctors on your behalf.

Can a Lasting Power of Attorney refuse treatment?

Your attorneys do not have the power to refuse treatment on your behalf, these decisions are made by medical professionals. However, a Power of Attorney allows you to specify any preferences (guidance) or instructions (obligations) for your attorneys so that they can consult with medical professionals. This can include preferences for medication or choice of care home for example. It also allows your attorneys to collect prescriptions on your behalf, have the authority to speak to doctors and attend appointments with you.

It also allows your attorneys to make decisions regarding life sustaining treatment. If you choose to provide authority to your attorneys, then they will make the decision as to whether treatment should continue or come to an end. If you chose to deny your attorneys such authority, then this decision will be left in the hands of the medical professionals. Most people tend to opt for the former as they are appointing trusted individuals who are guided by the medical professionals, but you may not want to give this responsibility to your attorneys. Every donor’s decision is individual.

Attorney Duties and Responsibilities

Guidance for attorneys, including their role and responsibilities, can be found here.

Who is the best person to be power of attorney?

It is up to you to decide who is the best person to be your power of attorney. Crucially, your attorney(s) should be people you trust.

Who should I choose?

- You should appoint people that you trust. This can be a spouse, family member, friend, or solicitor for example.

- You can also appoint substitute attorneys if any of your chosen attorneys are unable to act.

- If you are only appointing one attorney, then it may be sensible to have a substitution. Although, if you are appointing 3 or 4 attorneys, then you may not feel this is necessary.

- It may also be helpful to appoint an attorney who is comfortable with completing administrative tasks such as paperwork and managing money.

- Practically it would be beneficial to appoint attorneys who live closely to you. Perhaps if you have an adult child living in another country, they could share the role with someone else more local such as another sibling?

Do all siblings have to agree on power of attorney?

If you are worried about appointing more than one attorney who do not see eye to eye, then you can specify how they are to make decisions.

Your attorneys can act in different ways:

Jointly

This is where they must make all decisions together. This can include significant decisions such as selling a house but can also include minor decisions such as attending the bank together to pay in a cheque. This can be impractical at times and difficult if attorneys disagree on matters.

Jointly and severally

This allows your attorneys to make some decisions jointly and some independently. This is the most common and flexible form of appointment. This way your attorneys could make significant decisions jointly and everyday decisions individually. It is up to your attorneys when they choose to act together or alone.

Jointly for some decisions, jointly and severally for other decisions

This option allows you to specifically list which decisions your attorneys should make jointly and which decisions they are able to make alone. This is beneficial if you are concerned about which decisions you wish for your attorneys to make together. However, if one of your attorneys dies, then none of your attorneys will be able to make these ‘joint’ decisions. This also applies to option 1.

Can I have an Enduring Power of Attorney and a Lasting Power of Attorney?

If you have an Enduring Power of Attorney, this is still valid for financial decisions, but you may want to think about making an LPA for Health and Welfare matters. If you have an EPA and decide to update to a financial LPA, your EPA will need to be revoked.

What is an Enduring Power of Attorney?

An Enduring Power of Attorney (EPA) is also a legal document which allows you to appoint attorneys to deal with your affairs on your behalf. However, it is only effective if made and signed before October 1, 2007. Therefore, if you made an EPA before this date, this can still be used. Presently, you can no longer make EPAs and instead must make an LPA.

Can I make a Lasting Power of Attorney if I already have an Enduring Power of Attorney?

If you already have an EPA, then this will be effective, but it is recommended that you update your EPA to an LPA if you wish to.

EPAs can only be used in relation to Property and Financial Affairs (not Health and Welfare).

EPAs are not registered with the Office of the Public Guardian straight away. They can only be used and registered once they are required (when the donor has lost capacity). However, financial LPAs can be used as soon as they are registered and are more flexible in nature.

If you were to consider updating your EPA to an LPA, then your EPA will need to be revoked if not already registered at the Office of the Public Guardian. It is important to remember that you must still have the capacity to update to an LPA.

How long does Lasting Power of Attorney last?

The word ‘Lasting’ means that they are in place for the remainder of your life. However, you can revoke or update your LPA if you still have the capacity to do so. Once you have lost capacity, this cannot be changed.

Should everyone have a Lasting Power of Attorney?

It is strongly recommended that everyone has an LPA regardless of age or assets. An LPA is a safety net if you have an accident or become unwell through illnesses such as dementia or strokes.

You do not need to be an older person to make an LPA. Accidents or critical illness can happen at any time. It is important that trusted individuals are appointed to deal with your affairs if you become unable to do so.

Without an LPA, you lose the control to choose who will make decisions for you if you are unable to. Therefore, someone you may not have chosen could end up making key decisions for you. For example, where you live and what medical treatment you receive.

Further information about Power of Attorney from Martin Lewis is here.

Why use a solicitor for Lasting Power of Attorney?

There are many advantages to using a solicitor for your Lasting Power of Attorney.

An LPA is a vital legal document which provides powers to other people. It can be detrimental without the necessary safeguards and legal advice. A solicitor ensures that you have the capacity to make the power and understand your decisions. We can also assist with the practicalities of the forms which are long with specific requirements. If these are completed incorrectly, they will be returned by the Office of the Public Guardian. There are currently severe registration delays at the OPG and incorrect documents will cause further delays.

You can read more about LPA registration delays here.

Can you do an LPA without a solicitor?

You can make an LPA without a solicitor. However, we strongly recommend you consult a solicitor, for the reasons above.

Contact Us

We are solicitors specialising in LPAs in Welwyn Garden City, Hertfordshire. If you would like our assistance with making an LPA, please contact our Wills, Trusts and Probate team. Please call 01707 329 333 or email wills@crane-staples.co.uk. We look forward to hearing from you.

Article written by Amy Tapping